Review Chapter 1: Audit Documentation (PSP_DAT5Cjune2020)

1)MUHAMMAD MUAZ BIN MOHD HASSAN (10DAT18F1012)

2)AZLINA BINTI ABDUL LATIF (10DAT18F1087)

3)SALY YAM INMA ANZIRA BINTI ABDUL AZIZ YAM (10DAT18F1081)

4)NIVASHINI A/P SURESH (10DAT18F1064)

5)RIKHA SARI BINTI ZAINUDDIN GOPAL (10DAT18F1077)

6)SITI NOR AISHAH BINTI SHAHUDDIN (10DAT18F1083)

INTRODUCTION

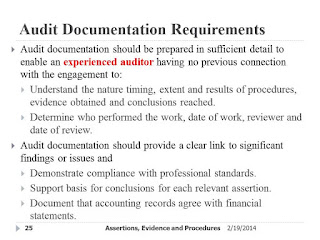

Audit documentation stands for the documentation or records of the procedures that the auditors have conducted, the audit evidence that they got, as well as the conclusion they have made according to the evidence they acquire. Sometimes, people would call audit documentation as an audit working paper.

Some examples of internal audit documentation are the internal control documents which the auditor has prepared in Microsoft Excel, Microsoft Word or various other application.

Another example which describes audit documentation will be the working paper which an auditor will usually prepare to record and test expenses for depreciation.

Refer to slide that we have prepared for more informations...

https://app.conceptboard.com/board/08cn-c3bg-i9fo-h2r5-upso

For more information:do watch this video...

Youtube link:

Questions:

Group 2: Explain the purpose of audit working paper

Group 3: Explain the purpose of audit documentation

Group 4: Define the nature of audit documentation

Group 5: What is the advantages of audit programme?

Group 6: Define audit programme.

Group 7: What is the purpose of Permanent file?

Group 8: What is the different between Permanent file and Current Audit file?

'BE ADDICTED TO YOUR PASSION,NOT YOUR DISTRACTION'

THANK YOU

Comments

Advantage of Audit Programme

1. Job Supervision

- By having a well-developed audit program, the audit team. He is in a position to know how work progresses. This improves employee work productivity.

2. Save Time and Work

- This is carried out according to the instructions and protocols contained in the audit programme. The audit software clearly shows all the instructions to be given to the assistant, which helps to complete the job in time. Furthermore, the audit program helps perform company audit in the coming years.

3. Improves Efficiency

- Many of an auditor 's duties are divided into the number of staff considering their skill and knowledge which helps to complete the audit work properly. It enhances audit team members' accountability to the work they perform. Likewise, the jobs are split between the assistant staff depending on their calibre, which tends to improve efficiency.

4. Helps to Control

- An auditor may compare the work done by the assistants on the basis of an audit system that helps monitor their work if any weaknesses are present. It helps in ensuring that attention is given to all-important areas during the audit.

5. Helps maintain uniformity

- Audit plan support is to set all the things in advance, and they are provided with training and guidance. Works are divided among the assistant staff; therefore there is no chance that unaudited statements may be left. If the audit work is carried out on an annual basis on the basis of the audit program, uniformity can be maintained in the audit work which helps to compare the report of different years.

6. Helps to Make Responsible

- In the audit system the work of an assistant is clearly specified and the assistant places signature in the completed work. Reduces the number of misunderstandings between team members about audit work results. And, if any work is left out, an assistant can be made liable for such work.

7. Helps to Maintain Continuity

- The evaluation system clearly demonstrates the job completed and the task done procedures. And if any staff leaves the job or stays away, new workers will easily continue the job of an audit.

8. Useful for future and Present as Proof

- An auditor can present the audit program as evidence if he/she has been charged with malfeasance or negligence and may obtain clearance from such accusation. It requires the auditor explicitly to maintain a database of relevant knowledge for future audits and references.Upon completion of an audit serves audit record function and may be useful for future reference. The audit program can be presented in the court also.

Purpose of audit documentation

- Assist the engagement team in planning and performing the audit.

- Used to record matters of continuing significant for future audit of company.

PURPOSE OF AUDIT WORKING PAPERS

Working papers are evidence of work done by the auditor,he should prepare working papers in order to provide evidence that audit was properly performed according to ISA Standart. Workind papers support auditor,in case he is being sued in court by the client for negligence od audit work.

- assist in the planning and performance of the audit.

- assist in the supervision and review of audit work.

- record the audit evidence resulting from the audit work perform to support the auditors opinion’s.

Audit documentation is the record of procedures performed, evidence obtained, and conclusions reached as part of an audit. It shows auditors in later years how the audit was conducted. It can be used as a training tool for junior auditors.

Permanent Audit File And Current Audit File:

* Permanent audit files are the files that use to save the information that uses by auditors uninterruptedly. That information contains engagement later, client's M&A, long term contract or agreement as well as board meeting minute.

* Current audit files are the files that save all information associated to current year auditing. Those documents contain the current year financial statements, general ledger, management accounts, and supporting documents.

Definition the nature of audit documentation also known as audit working paper is the primary record of audit procedures performed, relevant audit evidence obtained and conclusions the auditor reached as a part of an audit.

Group 7

Permanent File

Permanent file content documents which we continually refer over number of years. Keeps information or documents that subject to be used in the next audit period.

Permanent Audit File And Current Audit File:

* Permanent audit files are the files that use to save the information that uses by auditors uninterruptedly. That information contains engagement later, client's M&A, long term contract or agreement as well as board meeting minute.

* Current audit files are the files that save all information associated to current year auditing. Those documents contain the current year financial statements, general ledger, management accounts, and supporting documents.