Review Chapter 3: Audit On Financial Statement (PSP_DAT5BJune2020)

Assalamualaikum dan Selamat Sejahtera 😊

Welcome to Our Blog ✌

Chapter 3: Audit On Financial Statement

Group Member :

1)Intan Sahira Uzma Binti Norizan (10DAT18F1116)

2)Siti Nuraisyah Binti Mad Khalid (10DAT18F1118)

3)Nur Syahirah Binti Suhaimi (10DAT18F1018)

4)Lelothane A/P Mohan (10DAT18F1094)

5)Muhamad Syahmi Bin Ibrahim (10DAT18F1041)

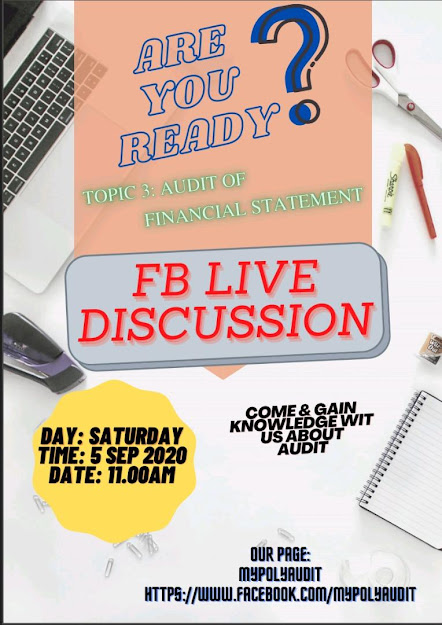

Our Discussion In This Chapter at Facebook :

4)Lelothane A/P Mohan (10DAT18F1094)

5)Muhamad Syahmi Bin Ibrahim (10DAT18F1041)

Our Discussion In This Chapter at Facebook :

Our Slide :

https://app.conceptboard.com/board/n0e6-6xsp-arch-i832-p52m

Youtube for more information :

https://www.youtube.com/watch?v=t0fxxJyRS4k

We believe all of you can do it 😘

Question :

Question :

1. What is the purpose of auditing the expenditure?

2. Give us two type of audit test for expenditure components.

3. List down five audit assertions.

4. What is the purpose of cash and bank balances evidence?

5. State the purpose of audit on investment?

6. What is the purpose of auditing trade receivables?

7. What is the risk assessment procedures on inventories and work in progress?

5. State the purpose of audit on investment?

6. What is the purpose of auditing trade receivables?

7. What is the risk assessment procedures on inventories and work in progress?

THANK YOU ✌❤

Comments

2. Test of control and Subtantive test

3. - Existence

- Completeness

- Accuracy

- Cut-off

- Classification

4. Consists of comfirmation of bank balances and other matters from the client's

bankers at the period end

5. To conduct of manage an investment audit with confidence

6. The receiveable exist and then amounts are collectible

7. - Understanding the entity to identify inherent risks

- Obtaining an understanding of internal controls over inventory

- Assessing risks of material misstatements

- Designing futher audit procedures

1. To ensure that the transaction pertaining to a period are recorded in the period

2. Test of control and Subtantive test

3. - Existence

- Completeness

- Accuracy

- Cut-off

- Classification

4. Consists of comfirmation of bank balances and other matters from the client's

bankers at the period end

5. To conduct of manage an investment audit with confidence

6. The receiveable exist and then amounts are collectible

7. - Understanding the entity to identify inherent risks

- Obtaining an understanding of internal controls over inventory

- Assessing risks of material misstatements

- Designing futher audit procedures

1.Audit objective for purchases are

concerned with obtaining sufficient

audit evidence for the transaction.

All purchases are recorded and not

understand and the purchases are

genuine.

2.-Test of control

-Substantive test

3.-Occurance

-Completeness

-Existence

-Accurancy

-Classification

4.Verify that the cash balance and

deposit are accurate and verify that

cash disbursements are promptly

recorded in the proper amount.

5.To conduct or manage an investment

audit with confidence. To make sure

the various types of investments are

not materially misstated and to

detect fraud and control investment

risk.

6.The receivables exist and the amount

are collectible. Provision for

doubtful debts are adequately

provided for the receivable that

have become a bad debt or are

doubtful in term of their

collectability.

7.-Understanding the entity to

identify inherent risks

-Obtaining an understanding of

internal controls over inventory.

-Assessing risks of material

misstatement.

-Designing futher audit procedures.

1. To ensure that there are no fraud

2. Test of control and subtantive test

3. -Completness

- Accurancy

- classification

- Cut-off

- Occurrence

4. Verify that the cash and bank balanc and deposits are accurate

5. . To conduct of manage an investment audit with confidence

6. -The receivables exist and the amounts are collectible

-

- Consider whether the revenue recognition policy is appropriate.

7. Obtaining an understanding of internal controls over inventory

- Assessing risks of material misstatement.

1. To ensure that the transaction pertaining to a period are recorded in the period

2. Test of control and Subtantive test

3. - Existence

- Completeness

- Accuracy

- Cut-off

- Classification

4. Consists of comfirmation of bank balances and other matters from the client's

bankers at the period end

5. To conduct of manage an investment audit with confidence

6. The receiveable exist and then amounts are collectible

7. - Understanding the entity to identify inherent risks

- Obtaining an understanding of internal controls over inventory