CHAPTER 1: AUDIT DOCUMENTATION (PSP_DAT5BDEC2020)

CHAPTER 1: AUDIT DOCUMENTATION

Hello and welcome guys to our blog !

Glad you came by. We wanted to welcome you and let you know we appreaciate you spending time here at the blog very much <3

Content Creator:

1) NURUL HIDAYAH BINTI MD SHAMSHURI (10DAT18F2011)

2) MUHAMMAD IFTIKHAR BIN MOHAMAD HANIFFA (10DAT18F2029)

3) MAISARAH BINTI IBRAHIM (10DAT18F2037)

4) ZAINUR ATIKA BINTI ZAWAWI (10DAT18F2047)

5) MELANIE ATHINA BINTI ERWIN MUKRIZ ( 10DAT18F2076)

Assalamualaikum dan selamat sejahtera..

Introduction to Audit Documentation.

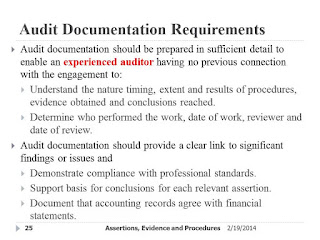

• Audit documentation is the principal record of the basis for the auditor‟s conclusions and provides the principal support for the representations in the auditor‟s report.

• “Documentation means the material (working papers) prepared by and for, or obtained and retained by the auditor in connection with the performance of the audit. Working papers may be in the form of data stored on paper, film, electronic media or other media.” ISA 230

• Audit documentation includes records on the planning and performance of the work, the procedures performed, evidence obtained, and conclusions reached by the auditor.

• ISA 230 states: “The auditor should record in the working papers information on planning the audit, the nature, timing and extent of the audit procedures performed and the results thereof, and the conclusions drawn from the audit evidence obtained.”

Working Paper ?

Are a direct aid in the planing, performance, and supervision of the audit;

Record the audit evidence resulting from the audit work performed to provide support for the auditor‟s opinion including the representation.

Assist in review of the audit work.

Provide proof of the adequacy of the audit

For more information, you guys can check out our :-

Sway : https://sway.office.com/DSRqAektQm6s0vSm?ref=Link

Facebook : https://www.facebook.com/mypolyaudit/?__tn__=%3C

Question for every group :

Group 2: State reason why the auditor is the owner of working paper ?

Group 3: Give the example of Permanent Audit File(PAF) and Current Audit File(CAF).

Group 4: Definitation of Audit Documentation.

Group 5: What document are record in audit documentation ?

Group 6: What types of audit files or document that need to be kept in the files ?

Group 7: List all the contents in the working papers and give example.

Group 8: What is the factor that can affect the audit working paper ?

THANK YOU AND GOOD LUCK GUYS !

Comments

Analyses conducted.

Audit plans.

Checklists.

Confirmation letters.

Memoranda and correspondence regarding issues found.

Representation letters.

Summaries of significant findings.

What document are record in audit documentation ?

Examples of audit documentation include memoranda, confirmations, correspondence, schedules, audit programs, and letters of representation. Audit documentation may be in the form of paper, electronic files, or other media.

1. The nature of information or data that being prepare or documents

2. Timing including the audit period that covers, and the date prepare

3. Name of the auditor who prepares audit working papers

4. The extent of the audit procedures performed to comply with the ISAs and applicable legal and regulatory requirements.

a) The nature, timing and extent of the audit procedures performed to comply with the ISAs and applicable legal and regulatory requirements; (Ref: Para. A6-A7)

(b) The results of the audit procedures performed, and the audit evidence obtained; and

(c) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions. (REF PARA A8-A11)

(1) Some testing or sampling require auditor use their professional judgment and its importance to documents those judgments.

(2) During an audit, the auditor might found the significant mater related to financial statements, their ethics, as well as their process. The auditor should clearly document these things.

(3) The evidence that auditor obtains, the procedures that they use for testing and the result of testing should properly and clearly document in the audit working papers. This is to ensure that the reviewer could easily perform the quality review and to prove that the relevant standards are implementing.

Current audit files are the files that keep all information related to current year auditing. Those documents include the current year financial statements, general ledger, management accounts, and supporting documents.

Audit documentation is the record of audit procedures performed, relevant audit evidence obtained and the conclusions the auditor reached (ISA 230)

Group 7

1.Schedule of debtors and creditors.

2.Trial Balance.

.Certificate of officials regarding certain important matters like bad debts, valuation of stock, unpaid expenses, accrued incomes, etc.

Statement of depreciation.

3.Correspondence between the auditor and the debtors, creditors, etc. of the client.

4.Investment Schedules.

5.Confirmation by the bank regarding the bank balances of the client.

6.Bank Reconciliation Statement.

7.Important extracts from the minute books such as agreement with vendors, hire purchasers, selling agents,

8.Detail of cash balance checked.

9.Adjustment entries.

10.Contingent liabilities certified by the management.

11.Draft financial accounts.

12.Details of clarifications made during the course of audit.

13.A copy of the auditor’s book.

14.Letters of representation.

15.Correspondence from legal advisors

16.Pertinent memoranda relating to the audit.

17.Data relating to the review of internal control.

18.Stock holder equity and the minutes.

19.Test of transactions.

Audit documentation is the written record of the basis for the auditor's conclusions that provides the support for the auditor's representations, whether those representations are contained in the auditor's report or otherwise. Audit documentation also facilitates the planning, performance, and supervision of the engagement, and is the basis for the review of the quality of the work because it provides the reviewer with written documentation of the evidence supporting the auditor's significant conclusions.

Audit documentation is to the records or documentation of procedures that auditors performed, the audit evidence that they obtained and the conclusion that makes by them based on the evidence obtained. Audit documentation is sometimes called audit working paper or working paper.

Contents of audit working paper

1. Schedule of Debtors, Creditors and bank statement.

2. Correspondences and balance confirmations from Debtors, Creditors and bankers.

3. Correspondences from legal advisors and statutory authorities.

4. Certificates of officials with regard to bad debts.

5. Certificate from valuers for valuing stock-in-trade and investments.

6. Certificate confirming cash balance.

7. Certificate from authorized person with regard to outstanding assets and liabilities, contingent assets and liabilities etc.

8. Bank Reconciliation statement.

9. Adjusting entries.

10. Copies of the minutes of the meeting of directors and shareholders

Factors affecting the auditor's judgment about the quantity, type, and content of the working papers for a particular engagement include :

(a) the nature of the engagement

(b) the nature of the auditor's report

(c) the nature of the financial statements, schedules, or other information on which the auditor is reporting

(d) the nature and condition of the client's records

(e) the assessed level of control risk

(f) the needs in the particular circumstances for supervision and review of the work.