GROUP 6 > CHAPTER 6 : AUDIT REPORT

Welcome everyone !

Thanks so much for stopping by✨

Here is something you probably want to check out 👉🏻 CHAPTER 6 : AUDIT REPORT

CONTENT CREATOR:

NUR ATHIRAH BINTI MOHAMED SULTAN

10DAT18F2009

VAISHNAVI D/O THINAGARAN

10DAT18F2033

NAANDEENI D/O BALACHANDRAN

10DAT18F2035

SHOBHA D/O VARATHARAZOO

10DAT18F2060

10DAT18F2062

Assalamualaikum,Selamat Sejahtera and Vanakam!!!!

Introduction to Audit Report.An audit report is a written opinion of an auditors regarding an organisation's financial statement. This report is written in a standard format, as mandated by the Companies Act 2016 and International Standards on Auditing (ISA). The audit report is issued to the users of an entity's financial statements.

AUDIT REPORT ACCORDING TO THE STATUTORY REQUIREMENT

The auditors’ report as Malaysian Approved Standards/Conforming Amendments:

(a) ISA 700 (Revised), Forming an Opinion and Reporting on Financial Statements;

(b) ISA 701, Communicating Key Audit Matters in the Independent Auditor’s Report;

(c) ISA 705 (Revised), Modifications to the Opinion in the Independent Auditor’s Report;

(d) ISA 706 (Revised), Emphasis of Matter Paragraphs and Other Matter Paragraphs in the Independent Auditor’s Report;

(e) ISA 720 (Revised), The Auditor’s Responsibilities Relating to Other Information;

(f) ISA 570 (Revised), Going Concern;

(g) ISA 260 (Revised), Communication with Those Charged with Governance; and

(h) Conforming Amendments to Other ISAs.

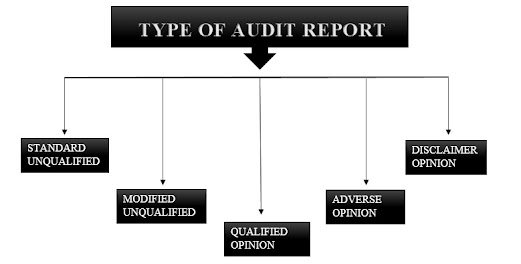

TYPES OF AUDIT REPORT

a) UNMODIFIED REPORT

An unqualified report or clean audit report ( unmodified report ) is issued when the auditor concludes that the financial statements give a true and fair view, in accordance with the applicable financial reporting framework and , additionally , the audit has been performed in accordance with the approved standards on auditing.

b) MODIFIED REPORT

An auditor's report is considered modified when the auditor fails to obtain sufficient audit evidence and is unable to express an unqualified audit opinion. The auditor's report can be modified if there is a :

(1) Qualified and adverse opinion ( materially misstated )

(2) Qualified opinion, as the auditor is unable to obtain sufficient audit evidence

(3) Disclaimer opinion due to the auditor being unable to obtain sufficient audit evidence

REPORTS WITH UNMODIFIED OPINION

1.Standard Qualified

*Financial statements prepared in accordance with MPERS for companies with no

subsidiaries

*Financial statements prepared in accordance with MPERS for companies with

subsidiaries

*Financial statements prepared in accordance with MPERS for the first time

2.Unqualified with explanatory paragraph or modified wording

*Emphasis of matter or significant uncertainty

*Auditor agrees with a departure from approved accounting standard

*Going concern-unmodified opinion when a material uncertainty exist and disclosure in

the financial statements in adequate

*The report is a shared report involving the use of other auditors

*Lack of consistent application of approved accounting standard

REPORTS WITH MODIFIED REPORT

Qualified audit report

An auditor expresses a qualified audit report when there is a limitation on the scope of the auditor's examination, or a disagreement with material consequences, but not pervasive to the financial statement. The auditor believes that the overall financial statements are fairly presented. With a qualified opinion, the opinion paragraph is modified by the words 'except for'.

Disclaimer audit report

- A disclaimer audit report is issued when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be both material and pervasive. Thus, the auditor is unable to obtain sufficient evidence to form an opinion on the overall financial statements.

Adverse audit report

- An adverse opinion is expressed when the effect of disagreement is material and pervasive to the financial statement. The auditor believes the overall financial statements are so materially misstated or misleading that they do not present fairly in accordance with the approved accounting standards.

ELEMENTS OF STANDARD UNQUALIFIED AUDIT REPORT

According to ISA 700, an audit report should include:

(a)A title;

(b)An addressee, as required by the circumstances of the engagement;

(c)An introductory paragraph that identifies the financial statements audited;

(d)A description of the responsibility of management for the preparation of the financial statements;

(e)A description of the auditor's responsibility to express an opinion on the financial statement and the

scope of the audit, that includes:

• A reference to the relevant ISAS and the law or regulation;

• A description of an audit in accordance with those standards;

(f) An opinion paragraph containing an expression of opinion on the financial statements and a reference to the applicable financial reporting framework used to prepare the financial statements (including identifying the jurisdiction of origin of the financial reporting framework that is not the International Financial Reporting Standard or International Public Sector Accounting Standards;

(g) The auditor's signature;

(h) The date of the auditor's report,

(i)The auditor's address.

AUDITOR'S RESPONSIBILITIES

According to ISA 700 (Revised), the auditor's responsibility towards financial statements are as follows:

- Identifying and assessing the risks of material misstatements (fraud or errors) in

financial statements

- Performing audit procedures and obtaining sufficient audit evidence

- Understanding the internal control which is relevant to the audit procedures

- Evaluating the appropriateness of accounting policies used

- Concluding the management's use of the going concern basis

SUMMARY

> The financial statements submitted for auditing must be free from material misstatements.

> Misstatements refer to incorrect or omitted information in the financial statements.

Examples include the incorrect or incomplete classification of transactions, or incorrect

values placed on assets, liabilities or financial obligations and commitments.

> The objective of an audit of financial statements is to express an audit opinion on

whether the financial statements fairly present the financial position of auditees at

financial year-end and the results of their operations for that financial year.

> Audit reports can be categorized into unqualified audit report, qualified audit report,

disclaimer audit report and adverse audit report.

> In some circumstances, the unqualified audit report may be modified by adding an

emphasis of matter paragraph.

> Emphasis of matter is an explanatory paragraph to highlight a matter which is included

in a note to the financial statements.

For more information click the link below:

Sway

QUESTION FOR EVERY GROUP

Group 1:Define audit report according to the statutory requirement

Group 2: State the types of audit report

Group 3:Describe auditors responsibilities

Group 4:Explain the matters that affect the auditors responsibilities

Group 5:Explain the matters that doesn't affect auditor's responsibilities

Group 7:What is qualified audit report? Explain briefly your answer

Group 8:What is adverse audit report? Explain briefly your answer

Comments

I having many kinds of knowledge from your blog.. keep sharing ! if you want Tax Return Filing in bangalore Income Tax Returns Filing in bangalore click on it

An audit report is a written opinion of an auditor regarding an entity's financial statements. The report is written in a standard format, as mandated by generally accepted auditing standards (GAAS). GAAS requires or allows certain variations in the report, depending upon the circumstances of the audit work in which the auditor engages.

Ensures compliance with established internal control procedures by examining records, reports, operating practices, and documentation.

Verifies assets and liabilities by comparing items to documentation.

Completes audit workpapers by documenting audit tests and findings.

An adverse Audit report is auditors who aren’t at all satisfied with the financial statements or who discover a high level of material misstatements or irregularities know that this creates a situation in which investors and the government will mistrust the company’s financial reports. An adverse audit report usually indicates that financial reports contain gross misstatements and have the potential for fraud. Adverse opinions send out a high alert that the company’s records haven’t been prepared according to GAAP. Financial institutions and investors take this opinion seriously and will reject doing any kind of business with the company.

-standard unqualified

-modified unqualified

-qualified opinion

-adverse opinion

-disclaimer opinion

The simple meaning of qualified audit report is that the accounting information that presents in the financial statements is not correct. ... In the qualified audit report, there is a qualified audit opinion that expresses by auditors and stating the reason why the qualified opinion is expressed.

Emphasis of Matter Paragraphs in the Auditor’s Report

Examples of circumstances where the auditor may consider it necessary to include an

Emphasis of Matter are:

• An uncertainty relating to the future outcome of exceptional litigation or regulatory

action.

• Early application (where permitted) of a new accounting standard (for example, a

new International Financial Reporting Standard) that has a pervasive effect on the

financial statements in advance of its effective date.

• A major catastrophe that has had, or continues to have, a significant effect on the

entity’s financial position.