MINI PROJECT - FRASER & NEAVE HOLDINGS BHD

PART C : FINDING AND CONCLUSION

Based on the significant changes observed in the financial ratios between 2022 and 2023, you are required to:

1. Verify the potential impact of these variations on the company's business risk, going concern status and any relevant issue.

1. Receivables Credit :

- An increase in receivables credit may indicate that the company is facing challenges in collecting payments from customers, potentially increasing its business risk.

- Higher receivables could affect cash flow and liquidity, impacting the company's ability to meet its short-term obligations.

2. Creditors Settlement :

- A change in creditors' settlement could impact the company's working capital management.

- If the company is taking longer to settle its payables, it may strain relationships with suppliers and affect its liquidity.

3. Inventories Turnover :

- A decrease in inventory turnover may suggest that the company is holding excess inventory, tying up capital and potentially leading to obsolescence or carrying costs.

- Lower inventory turnover can impact liquidity and profitability, affecting the company's overall financial health.

4. Liquidity Current Ratio :

- A decline in the current ratio may indicate a reduced ability to cover short-term liabilities with current assets.

- A lower current ratio could signal liquidity issues and raise concerns about the company's ability to meet its financial obligations.

5. Liquidity Quick Ratio :

- Changes in the quick ratio reflect the company's ability to meet immediate short-term obligations with liquid assets.

- A decrease in the quick ratio could indicate potential liquidity constraints, impacting the company's going concern status.

6. Gearing 1 and Gearing 2 :

- Gearing ratios measure the extent to which the company relies on debt financing.

- An increase in gearing ratios may indicate higher financial leverage and risk, potentially affecting the company's creditworthiness and business risk.

In summary, the observed changes in these financial ratios for FRASER & NEAVE HOLDINGS BHD could have implications for its business risk, going concern status, and overall financial health. It is important for the company to closely monitor these ratios, identify the root causes of the changes, and take appropriate measures to address any underlying issues to ensure sustainable business operations and financial stability.

2. Prepare the steps would you take to corroborate the information obtained from this analytical procedure with other audit evidence, such as documentation supporting management's assertions and external sources of information.

Review Documentation: Gather and review relevant documentation provided by management, such as financial statements, accounting records, contracts, invoices, and other supporting documents.

Assess Internal Controls: Evaluate the effectiveness of internal controls related to the financial reporting process. This includes understanding the control environment, assessing control activities, and determining whether controls are properly designed and implemented.

Perform Substantive

Procedures: Conduct substantive procedures, including tests of details and substantive analytical procedures, to gather additional audit evidence. This may involve confirming account balances with third parties, examining supporting documentation for transactions, and testing the accuracy and completeness of recorded amounts.

Verify External Sources: Validate information obtained from external sources, such as banks, customers, suppliers, and regulatory agencies. This may involve confirming account balances, contractual terms, and other relevant information directly with external parties.

Compare Results: Compare the results of the analytical procedure with other audit evidence gathered. Assess any discrepancies or inconsistencies and investigate further to understand the reasons behind them.

Assess Reliability: Evaluate the reliability and relevance of the different types of audit evidence obtained. Consider factors such as the source, nature, and consistency of the information.

Consider Audit Assertions: Assess how the information obtained from different sources corroborates management's assertions related to the financial statements, such as completeness, accuracy, valuation, existence, rights and obligations, and presentation and disclosure.

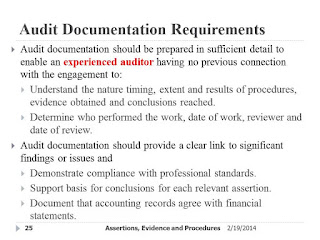

Document Findings: Document the audit procedures performed, the evidence obtained, and any conclusions reached regarding the reliability and sufficiency of the audit evidence gathered to support the audit opinion.

Obtain Audit Committee

Approval: Present the findings and conclusions to the audit committee for review and approval, ensuring transparency and accountability in the audit process.

3. Explain additional audit procedures would you recommend to understand the underlying reasons behind these variations.

Additional Audit Procedures to Understand the Reasons Behind Variations : To understand the underlying reasons behind the variations in financial ratios, auditors may conduct the following additional audit procedures:

- Perform detailed substantive testing on accounts affected by the variations, such as accounts receivable, inventory, and expenses, to identify any irregularities or misstatements.

- Analyze management's explanations for the changes and assess the reasonableness of their assumptions and estimates.

- Evaluate the impact of significant events or transactions, such as acquisitions, divestitures, restructuring activities, or changes in accounting policies, on the financial ratios.

- Review internal management reports, budgets, and forecasts to assess the company's short-term and long-term financial outlook.

- Consider external factors, such as changes in regulatory requirements, market conditions, competitive landscape, and macroeconomic factors, that may have influenced the company's financial performance.

- Engage specialists, such as valuation experts or industry analysts, to provide insights into complex accounting issues or industry-specific trends affecting the variations in financial ratios.

By performing these audit procedures, auditors can gain a comprehensive understanding of the reasons behind the observed variations in financial ratios and assess their implications for the company's business risk, going concern status, and overall financial performance.

Comments