Mini project (GROUP 5)

|

Name: 1.

KALAIMATHI A/P MURUGAN 2.

JEYASHREE A/P GANESAN 3.

AKMAL MUHAMMAD BIN AHMAD

RIZAL |

Class: DAT 5B |

URL: |

|

Matrix No: 1.

10DAT20F2038 2.

10DAT20F2039 3.

10DAT21F2031 |

Group: GROUP 5 |

|

|

Rubric |

Part C |

Marks |

|

Content

at Mypoly Audit Blogspot |

1 |

|

|

2 |

|

|

|

3 |

|

|

|

Total Marks |

|

Part A: Find the Annual Report

Get an annual

report of the company during the period 2022 - 2023 in the main market by

visiting https://www.bursamalaysia.com/trade/trading_resources/listing_directory/main_market.

Download this report and upload it on www.mypolyaudit.blogspot.com along with the task to

parts B and C.

Part B: Analyzing Problems

Calculate the

financial ratios for 2 years (2022 and 2023) and provide an analysis of the

significant ratio changes for 2 years. Please calculate the financial ratios in

the table below:

|

|

Financial

ratio |

2022

|

2023

|

Variance

|

|

|

RM |

RM |

RM |

% |

||

|

A1 |

Turnover (credit) |

103.19 |

14.02 |

(89.17) |

76% |

|

A2 |

Turnover (cash) |

9.68 |

4.85 |

(4.83) |

33% |

|

A |

Total turnover (A1 + A2) |

112.87 |

18.87 |

(94) |

71% |

|

B |

Trade purchases |

(3,296,071) |

(3,566,591) |

270,520 |

4% |

|

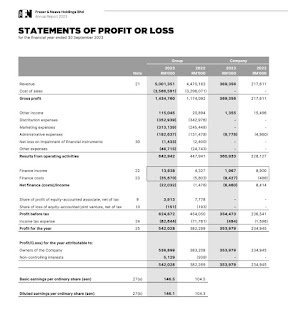

C |

Gross profit |

1,174,092 |

1,434,760 |

260,668 |

10% |

|

D |

Net profit |

(1,476) |

(22,032) |

20,556 |

87% |

|

E |

Property, plant and equipment |

1,458,344 |

1,592,064 |

133,720 |

4% |

|

F |

Inventories |

901,377 |

764,182 |

(137,195) |

8% |

|

G |

Trade Receivables |

866,369 |

713,342 |

(153,027) |

10% |

|

H |

Cash at bank/ in hand |

367,365 |

539,765 |

172,400 |

19% |

|

I |

Total current assets |

2,229,721 |

2,509,107 |

279,386 |

6% |

|

J |

Total assets |

4,190,630 |

5,111,617 |

920,987 |

10% |

|

K |

Trade payables |

320,335 |

309,773 |

(10,562) |

1.68% |

|

L |

Bank overdrafts and short–term borrowings |

210,000 |

706,000 |

496, 000 |

54% |

|

M Total current liabilities |

833,344 |

850,567 |

17, 223 |

1.02% |

|

|

N Total borrowing (including overdrafts) |

246,833 |

710,000 |

463, 167 |

48% |

|

|

O Net assets/shareholders` funds |

272,269 |

274,483 |

2, 214 |

0.4% |

|

|

Gross profit

(%) (C/A X 100) |

1,040,216 |

7,603,392 |

6, 563, 176 |

76% |

|

|

Net Profit

(%) (D/A

X 100) |

1,307.70 |

116,757 |

115, 449.3 |

98% |

|

|

Receivables`

credit (G/A1 X 12) |

100,750 |

5,088,031 |

4, 987, 280 |

96% |

|

|

Creditors` settlement (K/B X 12) |

1.17 |

1.04 |

(0.13) |

6% |

|

|

Inventories turnover (B/F) |

3.66 |

4.67 |

1.01 |

12% |

|

|

Liquidity current ratio (I/M) |

2.68 |

2.95 |

0.27 |

5% |

|

|

Liquidity quick ratio (I – F/M) |

2,229,720 |

2,059,106 |

(170, 614) |

4% |

|

|

Gearing

1 (N/J)

|

0.59 |

0.14 |

(0.45) |

62% |

|

|

Gearing

2 (N/O)

|

0.91 |

2.59 |

1.68 |

48% |

|

Part C: Finding and Conclusions

Based on the

significant changes observed in the financial ratios between 2022 and 2023, you

are required to:

1.

Verify the potential impact of

these variations on the company's business risk, going concern status and any

relevant issue.

·

Business Risk:

v External Factors: Variations can arise from external factors such as

inflation, supply chain disruptions, geopolitical upheavals, competitor

actions, reputational issues, or cyberattacks.

v Economic Risks: Economic conditions, market changes, and industry

trends can impact F&N’s operations and financial stability.

v Financial Risks: High debt levels, inadequate liquidity, or negative

cash flows pose risks to F&N’s financial health.

v Operational Risks: Labor disputes, quality control issues, or

operational disruptions may affect F&N’s ability to continue as a going

concern.

v Regulatory Risks: Changes in laws or enforcement actions can also

impact F&N’s operations.

·

Going Concern Status:

v Definition: Going concern assumes that F&N will continue

operating for the foreseeable future and meet its obligations. If substantial

doubt exists about this ability, adjustments to financial statements are

necessary.

·

Assessment Steps:

v Evaluate whether conditions indicate substantial doubt about

F&N’s ability to continue within one year after financial statement

issuance.

v Consider relevant factors (economic, financial, operational) that

impact F&N’s ability to meet obligations.

Ø Disclosure: If substantial doubt exists, F&N must disclose this

fact and provide reasons for the uncertainty.

·

Relevance to F&N Company:

v Assess the specific variations affecting F&N, considering

economic conditions, financial stability, operational challenges, and

regulatory changes.

v Monitor F&N’s liquidity, debt levels, cash flows, and

operational performance.

v Evaluate management’s plans to mitigate risks and ensure F&N’s

continuity as a going concern.

2.

Prepare the steps would you

take to corroborate the information obtained from this analytical procedure

with other audit evidence, such as documentation supporting management's

assertions and external sources of information.

·

Review Documentation:

v Examine relevant internal documentation provided by the company.

This may include financial statements, management reports, and internal memos.

v Verify that the analytical procedure results align with the data

presented in these documents.

·

Assess Management Assertions:

v Evaluate the management assertions related to the information being

analyzed. These assertions include completeness, accuracy, existence,

valuation, and rights and obligations.

v Compare the analytical results with management’s assertions to

identify any discrepancies.

·

External Sources:

v Gather information from external sources such as industry reports,

market data, economic indicators, and regulatory filings.

v Cross-reference the analytical findings with external data to

validate consistency and reasonableness.

·

Substantive Testing:

v Perform substantive testing procedures to obtain direct evidence.

These may include:

Ø Vouching: Selecting specific transactions or balances and tracing

them back to supporting documents.

Ø Confirmation: Obtaining confirmations from third parties (e.g.,

banks, customers, suppliers) regarding balances or transactions.

Ø Physical Inspection: Visiting physical locations to verify the

existence of assets or inventory.

Ø Reperformance: Independently recalculating financial figures.

Ø Reconciliation: Comparing records to external sources (e.g., bank

statements, supplier invoices).

·

Analytical Review:

v Conduct a comprehensive analytical review by comparing current data

with historical trends, industry benchmarks, and expectations.

v Investigate any significant deviations or anomalies.

·

Expert Opinion:

v Consult with industry experts or specialists to validate assumptions

made during the analytical procedure.

v Seek their opinion on the reasonableness of the results.

·

Management Inquiry:

v Interview management personnel to gain insights into the underlying

factors affecting the data.

v Discuss any discrepancies and seek explanations.

·

Audit Committee Communication:

v Share the results of the analytical procedure with the audit

committee.

v Discuss any concerns or findings that require further investigation.

·

Documentation:

v Document all steps taken, including the rationale behind decisions

made during the corroboration process.

v Maintain a clear audit trail for future reference.

3.

Explain additional audit

procedures would you recommend to understand the underlying reasons behind

these variations.

·

Interview Key Personnel:

v Schedule interviews with management, particularly those responsible

for financial reporting and operations.

v Seek insights into the specific events or changes that led to the

observed variations.

v Inquire about any significant business decisions, transactions, or

external factors that may have impacted the financial data.

·

Transaction Testing:

v Select a sample of individual transactions related to the

variations.

v Trace these transactions through the accounting system to understand

their origin, processing, and impact on financial statements.

v Investigate any anomalies or deviations from expected norms.

·

Comparative Analysis:

v Compare the current year’s data with prior years’ financial

statements.

v Identify trends, patterns, and significant changes.

v Analyze the reasons behind fluctuations in revenue, expenses, or

other relevant metrics.

·

Industry Benchmarking:

v Benchmark the company’s performance against industry peers.

v Obtain industry-specific data on key performance indicators (KPIs)

such as revenue growth, profit margins, and liquidity ratios.

v Assess whether the company’s variations are consistent with industry

norms.

·

Legal and Regulatory Compliance Review:

v Evaluate compliance with relevant laws and regulations.

v Investigate any legal disputes, pending litigation, or regulatory

changes that may impact financial results.

v Assess the potential financial implications of non-compliance.

·

Analyzing Non-Financial Data:

v Consider non-financial data related to the business, such as

customer satisfaction scores, employee turnover rates, or production

efficiency.

v Correlate non-financial metrics with financial variations to

identify potential cause-and-effect relationships.

·

Scenario Analysis:

v Conduct scenario-based assessments to simulate different business

scenarios.

v Explore how variations would change under different assumptions

(e.g., changes in sales volume, pricing, or cost structure).

v Assess the sensitivity of financial results to key variables.

·

Review Contracts and Agreements:

v Examine contracts, leases, and agreements entered into by the

company.

v Look for terms that may impact financial performance (e.g., revenue

recognition criteria, lease obligations, contingent liabilities).

·

External Expertise:

v Consult with industry experts, economists, or specialists in

specific areas (e.g., tax, legal, technology).

v Seek their opinions on the variations and potential underlying

causes.

·

Management Representations:

v Obtain written representations from management regarding the

accuracy and completeness of financial information.

v Address any discrepancies or uncertainties directly with management.

.jpg)

.jpg)

.jpg)

.jpg)

Comments