DPA50153 : AUDIT 2 MINI PROJECT (GROUP 3 - NESTLE (MALAYSIA) BERHAD)

FINANCIAL RATIOS FOR 2 YEARS ( 2023 AND 2024 )

AND ANALYSIS OF THE SIGNIFICANT RATIO CHANGES FOR 2 YEARS

PART C : FINDING AND CONCLUSIONS

BASED ON THE SIGNIFICANT CHANGES OBSERVED IN THE FINANCIAL RATIOS BETWEEN 2022 AND 2023

1. The potential impact of these variations on the company's

i. Business risk:

Business risk refers to the likelihood that the company will face challenges in maintaining stable operations due to financial, operational, or market changes.

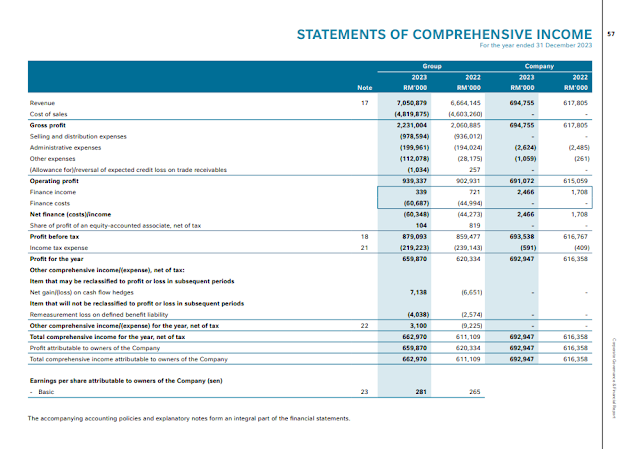

Gross profit increased slightly from 30.92% to 31.64%, which is positive, showing stable cost control. However, the minimal improvement may signal stagnant revenue growth, meaning the company could struggle to improve profitability without increasing sales or reducing costs further.

Net profit dropped from 0.91% to 0.63%. This indicates rising indirect costs or inefficiencies in operational expenses, which could lead to reduced investor confidence and future financial strain.

Inventory turnover improved significantly from 4.4601 times to 5.4560 times, which indicates efficient stock or inventory management. However, the decrease in inventory levels -25.44% raises concerns about whether the company is liquidating stock to cover short-term needs or if it is unable to replenish inventory due to supply chain issues and this may impact future operations.

Receivables' credit period increased slightly from 9.9183 months to 10.1575 months, meaning customers are taking longer to pay. This increases the risk of cash flow issues if the trend continues

Gearing ratios decreased significantly from 0.2214 to 0.0202 and from 1.2564 to 0.1066, reflecting reduced reliance on borrowing and improved financial stability.

ii. Going concern status

The going concern assumption assesses whether the company can meet its obligations and continue operating without liquidation in the foreseeable future.

The decrease in total current liabilities is -5.36% and total borrowings is -90.85% is a positive sign. It indicates the company is actively reducing its debt reliance, exposure and strengthening its liquidity, which improves financial stability.

However, the decrease in current assets to -18.33% is concerning, as it suggests the company may be using up liquid assets to cover liabilities or operational costs. Combined with reduced profitability, this could threaten the company’s ability to sustain itself if these trends persist.

Inventory reductions and net profit declines could indicate operational inefficiencies or declining demand.

Significant changes in liquidity ratios suggest potential cash flow challenges or reallocation of resources.

The reduced profitability and significant changes in working capital ratios indicate potential challenges with cost control and operational effectiveness.

2. Steps to corroborate the information obtained from analytical procedure with other

audit evidence, such as

i. Review management's assertions

Examine financial statements, notes, and management's justifications for changes, such as new business strategies, cost reduction initiatives or operational challenges regarding the significant ratio changes.

Assess whether the assumptions and judgments such as inventory valuation, revenue recognition are reasonable and supported by evidence. Moreover, ensure the explanations align with accounting policies and external factors about market conditions and industry benchmarks.

ii. Inspect supporting documentation

Revenue and sales records by verifying the accurancy of revenue figures of turnover (credit) and turnover (cash) and gross profit calculations.

Check inventory records for write-downs, obsolescence or unusual stock clearance activities.

Validate purchase orders, and sales invoices to verify inventory turnover.

Review contracts and agreements related to liabilities and borrowings to confirm reductions.

Examine significant expenses documentation such as marketing, rent, salaries and any other expenses that may explain the drop in the net profit.

Analyze and check aged receivables and payables records for consistency with receivables turnover, credit terms and to confirm delays in collections or payments.

iii. Use external sources

Do industry comparisons by comparing industry benchmarks gross profit, liquidity ratios and net profit ratios to assess competitiveness.

Obtain third-party confirmations such as banks, customers and suppliers to validate outstanding balances for borrowings, receivables and payables.

Consult credit rating agencies or bank reports to verify borrowing reductions.

By using these steps, it will help determine whether the observed changes reflect genuine business activities or if there are risks of errors, fraud, or misstatement

3. Additional audit procedures to understand the underlying reasons behind these variations

To investigate further, auditors should conduct specific procedures to identify the reasons behind the changes in financial ratios.

i) Net profit decline

Substantive testing by examine specific expense accounts such as utilities, salaries, depreciations and more to identify major contributiors to rising costs or decreasing revenue.

Investigate unusual non-recurring items or one-time expenses such as penalties and restructuring costs that may have affected profitability.

Review tax provisions to ensure they are accurate and compliant.

ii) Inventory management

Perform inventory counts by physically verify inventory to ensure accuracy in reported values and quantities in accordance with accounting standards, and to avoid any obsolescence, slow-moving or damage inventory.

Do supply chain analysis to investigate supply chain disruptions or production delays that could explain inventory shortages.

Analyze sales trends to determine whether the inventory reduction aligns with demand.

iii) Receivables and payables

Conduct a detailed review of receivables aging to identify overdue accounts, slow-paying customers or bad debts and assess whether provisions for doubtful debts are adequate.

Review supplier payment terms and history to ensure payables are correctly recorded.

Evaluate credit policy on whether the company has relaxed its credit terms to increase the risk of delayed payments or bad debts.

iv) Borrowing reductions

Verify repayment of borrowings through bank statements and agreements.

Review any agreements for refinancing or early repayment to assess their impact on financial ratios.

v) Cash flow and liquidity

Reconcile cash flow statements to ensure the company is generating sufficient operating cash flow and to understand cash inflows and outflows.

Perform stress sensitivity analysis on liquidity ratios to determine the company ability to meet short-term obligations.

vi) Revenue and turnover analysis

Ensure that revenue is recognized in the correct period with recognition policies and test compliance in accounting standards by perform substantive tests on revenue transactions to confirm turnover figures.

Compare revenue trends to identify fluctuations and determine whether these are due to genuine market conditions or errors in revenue recognition

Conclusion

The analysis and additional audit procedures provide a comprehensive understanding of the significant variations in the company’s financial ratios. The key focus should be on identifying whether the changes are temporary or systemic and ensuring the financial statements reflect the true financial position and performance of the company. These steps are crucial to assess the company’s business risk, going concern status, profitability, and operational efficiency while corroborating management’s assertions with sufficient evidence.

Comments