DPA50153 - Audit 2 Mini Project (PANASONIC)

PART C :

QUESTION 1

Verify the potential impact of these variations on the company's

business risk, going concern status and any relevant issues.

Impact on going concern status:

Higher profitability and liquidity ratios reduce the likelihood of

financial distress and enhance the company’s ability to continue its operations

in the foreseeable future.Disruptions in production, supply chain problems, or

inefficiencies in operations can affect Panasonic's ability to generate income

and maintain its business continuity.However its essential for the company to

maintain sustainable growth and manage its financial resources effectively to

ensure long term viability.

Relevant issues :

1.

Regulatory Compliance:

Changes in financial performance may impact regulatory compliance

requirements.Panasonic Company should ensure adherence to relevant regulations

and accounting standards to maintain trust and translucency among stakeholder.

2.

Capital Structure Management:

The capital structure management seeks to safeguard the ongoing business

operations, to ensure flexible access to capital markets and to secure adequate

funding at a competitive rate.As profitability and liquidity improve the

company may have opportunities to optimise its debt equity to support growth

initiatives.

3. Sustainability Of Improvement:

While the improvements in financial ratios are positive,it’s crucial for

the company to sustain these improvements over the long term.Management should

continuously monitor key performance indicators and implement strategies to

address potential challenges.

4.

Market Competition:

A competitive market, also referred to as a perfectly competitive

market, is a market structure with many people buying and selling identical

products, with each buyer and seller being a price taker. Agricultural produce,

internet technology, and the foreign exchange market are all examples of a

competitive market.

In conclusion the variations in financial ratios suggest positive trends

that could mitigate support going concern, enchance overall financial health

and business risk.However, it’s essential for the company to proactively manage

potential challenges and maintain a balanced approach to sustainable risk

management and growth.

QUESTION 2

Prepare the steps would you take to corroborate the information obtained

from this analytical procedure with other audit evidence, such as documentation

supporting management's assertions and external sources of information.

1.Understand the Analytical Procedure Results

- Review the results of the

analytical procedures and identify any significant fluctuations, trends, or

anomalies.

- Compare expectations against

actual results and determine if there are discrepancies that require further

investigation.

2.Obtain Supporting Documentation

- Request relevant documentation

from the management that supports the assertions being tested. This could

include financial statements, contracts, invoices, or internal reports.

- Examine documentation for consistency with the results of the

analytical procedures. Verify whether the documentation supports the amounts or

disclosures in the financial statements.

3.Compare with External Sources

-Identify reliable external sources of information that can corroborate

the results. This could include third-party confirmations, market data,

regulatory filings, or industry benchmarks.

-Cross-check information by comparing the results of the analytical

procedure with data from these external sources. This helps ensure the

information is accurate and reliable.

4.Assess Management's Explanations

-Inquire with management about any discrepancies identified. Understand

their rationale or explanations for the differences observed in the analytical

procedure.

- Evaluate the reasonableness of management’s explanations in light of

other audit evidence and corroborative documentation.

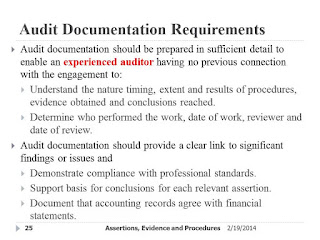

5.Document Your Findings

-Document the audit procedures performed, including the analytical

procedures, corroborative evidence obtained, and any conclusions drawn.

-Ensure that the documentation includes details of how the evidence was

corroborated and any follow-up actions taken.

6.Conclude on the Evidence

-Assess whether the corroborated evidence supports the financial

statement assertions.

-Determine if the audit evidence obtained is sufficient and appropriate

to form an opinion on the financial statements.

QUESTION 3

Explain additional audit procedures would you recommend to understand the underlying reasons behind these variations.

1. Inquiry with Management and Personnel

-Engage in discussions with management and relevant personnel to obtain explanations for the variations. Ask targeted questions to understand any changes in business operations, accounting policies, or external factors that may have led to the observed fluctuations.Compare the explanations provided with prior periods and other segments of the business to assess consistency and plausibility.

2. Detailed Transactional Testing

-Select a sample of transactions from the period where the variation

occurred and perform a detailed examination.

-Inspect the underlying documents for these transactions (e.g.,

invoices, contracts, purchase orders) to verify the accuracy, completeness, and

appropriateness of recorded amounts.

-Trace transactions from their origin to their final recording in the

financial statements (trace) or vouch the financial statement amounts back to

the original source documents.

3. Substantive Analytical

Procedures

-Use more precise or disaggregated data to develop specific expectations for certain accounts or transactions and compare them to actual results.

-Perform more focused ratio analyses (e.g., gross margin ratio, current

ratio) to identify which specific areas of the financial statements might

explain the variation.

4. Reperform Calculations

-Recompute critical figures and ratios used in the analytical procedure using independent data. This helps in verifying the accuracy of the original calculations.

-Conduct sensitivity analysis to understand how changes in assumptions

or inputs could have impacted the results.

5. Test for Fraudulent Activity

-Evaluate whether the variations could be indicative of potential fraud. This might involve looking for unusual transactions, round-dollar amounts, or other red flags.

-In cases of significant concern, consider using forensic audit

techniques to detect any manipulation or fraudulent activity.

6. Verify Adjustments and Reclassifications

Review adjusting journal entries and reclassifications made during the period to ensure they are justified and not used to manipulate the results.

Investigate any unusual or large reversals of prior period entries, as

these could artificially affect current period variations.

REFERENCE:

1. https://holdings.panasonic/global/corporate/about/code-of-conduct/chapter-4.html

2. https://holdings.panasonic/global/corporate/about/group-companies/phd/corporate-governance.html

4. https://www.indeed.com/career-advice/career-development/risks-business

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

Comments